55

extends an income tax for high income earners

Summary

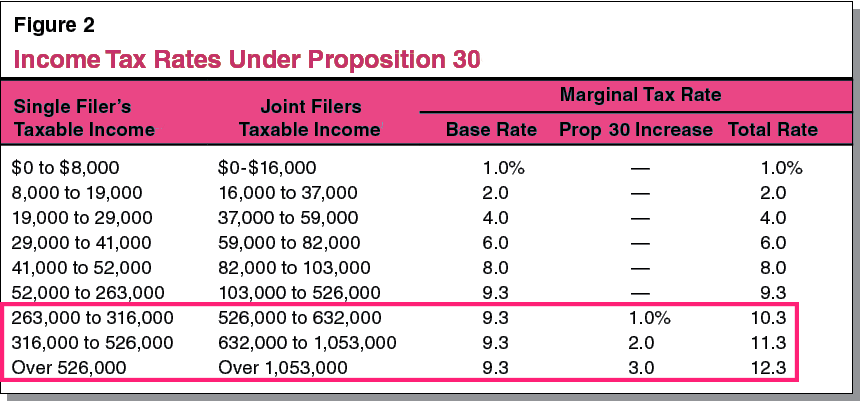

In 2012, voters approved Prop 30, which included a marginal tax rate increase of 1-3% on those making more than $263,000 a year (higher for couples, obviously). This also includes any small business that pays personal income tax instead of the state business tax. This tax is effective until 2018, but if passed, Prop 55 (the thing you're voting on) would extend the tax until 2030. By then, we expect President Trump won't have us paying taxes at all.[jk]

Prop 55 would extend Prop 30's increases in the income tax. Original graphic courtesy of the Legislative Analyst's Office.[3]

Woohoo, I don't make more than $263K a year. Why shouldn't I support this?

When people voted on Prop 30, voters were told that the tax would be "temporary," to alleviate the rainy day that was the recession. Here's the exact text from Prop 30, in 2012: "The new taxes in this measure are temporary. Under the California Constitution the 1/4-cent sales tax increase expires in four years, and the income tax increases for the wealthiest taxpayers end in seven years." Opponents argue that the tax was necessary in 2012, and now that things are a-okay again, we should no longer continue it.

Even though it's easy to just think about yourself in this case, it's important to consider what the greater effects are, and if this is good for the overall state system. The San Francisco Chronicle opposes the measure because we shouldn't be supporting the education system from income tax, but rather sales tax. Revenue from income tax is dependent on the economy. Many other publications, despite all saying that California's tax system needs reform, support the measure as necessary. The San Diego Tribune opposes the prop because they claim that the money will go to undeserving teachers, not the students.

Even though it's easy to just think about yourself in this case, it's important to consider what the greater effects are, and if this is good for the overall state system. The San Francisco Chronicle opposes the measure because we shouldn't be supporting the education system from income tax, but rather sales tax. Revenue from income tax is dependent on the economy. Many other publications, despite all saying that California's tax system needs reform, support the measure as necessary. The San Diego Tribune opposes the prop because they claim that the money will go to undeserving teachers, not the students.

“While it is being promoted as a way to maintain school funding, its dependence on the wealthiest taxpayers leaves education highly vulnerable to the next downturn, when capital gains typically vaporize.”

I make a lot of money.

👍 First, keep in mind that this is a marginal tax rate, meaning that you pay that tax rate for every dollar you have in that tax bracket. If that didn't make sense, read about it here. Assuming you weren't already going to, you might consider supporting this tax extension by reading about where the money is going and to keep in mind that your taxes won't be raised – but they won't be lowered back to pre-2012 rates either. In short, of the estimated $4 billion to $9 billion extra revenue expected, half will be spent on schools and community colleges, with the remaining half split between Medi-Cal and budget reserves in a TBD way.[3] As some papers argue, this is not the best solution, but lack of funding is worse.[8]

“It feels churlish to urge a “no” vote on Proposition 55, the initiative that would extend the income tax piece of Proposition 30 for another 12 years. Schools are important. Children are the future. And the state can’t compete economically without an educated workforce.”

Abridged, fact-checked rendition of a KQED podcast debate

California already has the highest taxes. Even if Prop 55 doesn't pass, we would still have the third highest tax rate

The tax would only affect those with the highest incomes. And it wouldn't raise any taxes, just keeps them as is.

But you're forgetting that the tax also affects small businesses – any S corporation or LLC.

It's a marginal tax rate, so just 1-3% more from the money made after $250K.

When this tax was imposed in 2012, it was voted on as a temporary tax. Prop 55 breaks that promise.

If the tax is not continued, there will be a $4 billion deficit in the budget, all coming out of education.

Brown said the state could manage if the tax wasn't extended, thanks to his rainy day fund.

And besides, if the state were at a loss without it, then it mismanaged its money.

Schools need the money, whether its extra or not.

More reading

Information last updated: Oct 23, 2016

[2] Ballotpedia details

[3] Legislative Analyst's Office summary

[$] Voter's Edge: where's the money coming from?

[4] KQED Podcast: live debate

[5] LA Business Federation article

[7] Mercury News: tax is needed

[8] Sacramento Bee: Yes, unenthusiastically

[9] Fresno Bee: Yes, because the alternative is worse

[11] San Diego Tribune: Three reasons to vote no

[11] LA Times: relies too much on the wealthy

Note: we intentionally omit the official arguments/rebuttals found in the official voter guide. We believe they exaggerate claims, mislead through emotions, and use ALL CAPS irresponsibly.

Mostly impartial information

[1] Full text of the proposition[2] Ballotpedia details

[3] Legislative Analyst's Office summary

[$] Voter's Edge: where's the money coming from?

[4] KQED Podcast: live debate

[5] LA Business Federation article

Arguments FOR Prop 55

[6] Bakersfield Californian: Stabilize the state budget[7] Mercury News: tax is needed

[8] Sacramento Bee: Yes, unenthusiastically

[9] Fresno Bee: Yes, because the alternative is worse

Arguments AGAINST Prop 55

[10] SF Chronicle: patching the tax system is not the answer[11] San Diego Tribune: Three reasons to vote no

[11] LA Times: relies too much on the wealthy

Note: we intentionally omit the official arguments/rebuttals found in the official voter guide. We believe they exaggerate claims, mislead through emotions, and use ALL CAPS irresponsibly.